When discussing eu vat rates there are going to be plenty of variations across the continent since nations have their separate rules and regulations for the treatment of goods and services. Home vat tables eu vat rates.

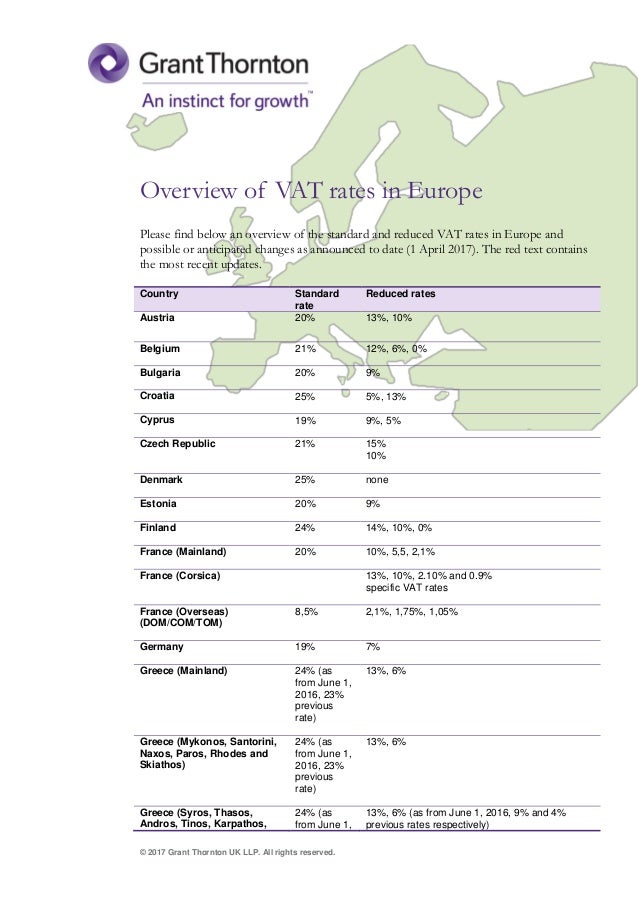

Vat Rates Eu October 2016 Grant Thornton

Vat Rates Eu October 2016 Grant Thornton

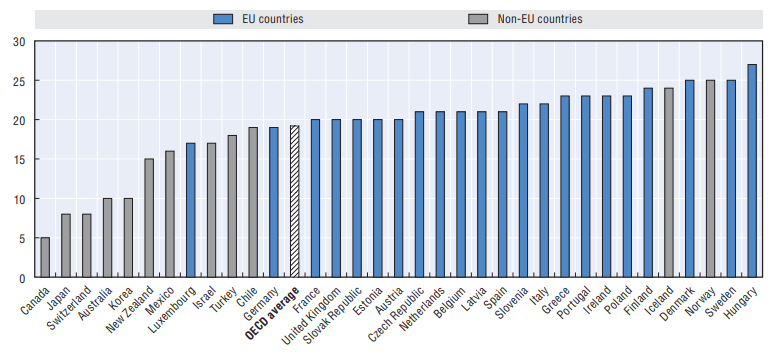

More than 140 countries worldwide including all european countries levy a value added tax vat on purchases for consumption.

The eu has standard rules on vat but these rules may be applied differently in each eu country. Einmal mehr soll steuergerechtigkeit geschaffen werden. As todays tax map shows although harmonized to some extent by the european union eu europes vat rates vary moderately across countries.

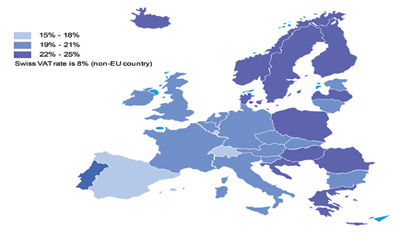

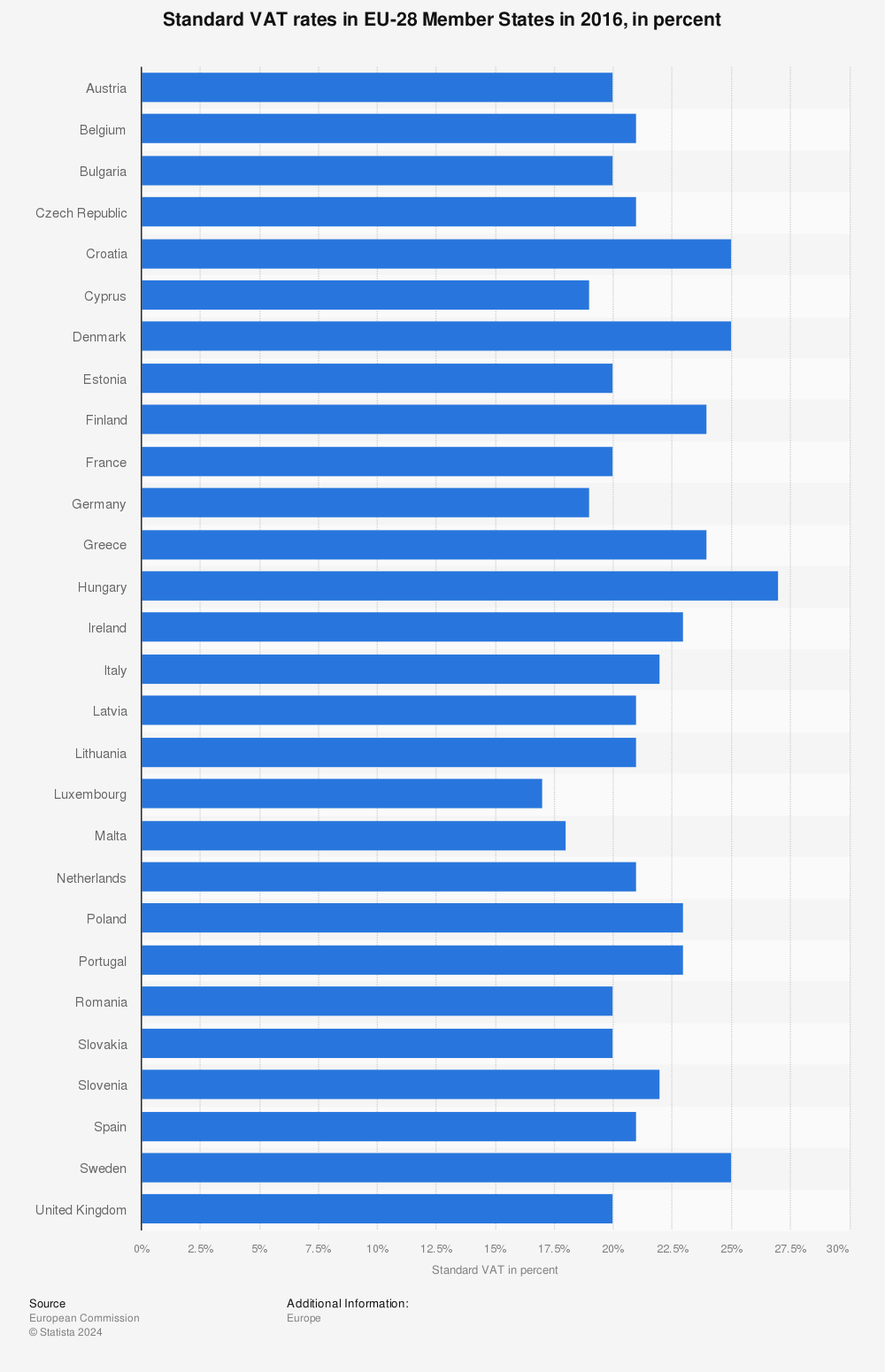

The eus institutions do not collect the tax but eu member states are each required to adopt a value added tax that complies with the eu vat code. Your refund will likely be less than the rate listed abo! ve especially if its subject to processing fees. Different rat! es of vat apply in different eu member states ranging from 17 in luxembourg to 27 in hungary.

The 28 member states are otherwise free to set their standard vat rates. The eu also permits a maximum of two reduced rates the lowest of which must be 5 or above. Some countries have variations on this including a third reduced vat rate which they had in place prior to their accession to the eu.

Eu vat standard rates are set by member countries and can fluctuate. The eu sets the broad vat rules through european vat directives and has set the minimum standard vat rate at 15. This enables them to keep special rates reduced rates under 5 including zero rates and reduced rates for goods and services other than those listed in the directive articles 102 128 vat directive.

Eu countries have flexibility about what vat rates they implement however the lowest standard rate that can be applied is 15. Within the principal eu v! at directive articles exist which dictate that eu member states must apply a standard rate of vat within a particular range and may also choose to apply a reduced vat rate no lower than 5 although certain eu member states may have derogations from this which allows a lower percentage.

Information About Taxes Amcharts

Information About Taxes Amcharts

Overview Of European Vat Rates

Overview Of European Vat Rates

Gtai Value Added Tax Vat

Changes In Standard Vat Rates In Eu 13 From 2008 To 2012 In Source

Changes In Standard Vat Rates In Eu 13 From 2008 To 2012 In Source

European Union Sales Tax Rate Vat 2019 Data Chart Calendar

European Union Sales Tax Rate Vat 2019 Data Chart Calendar

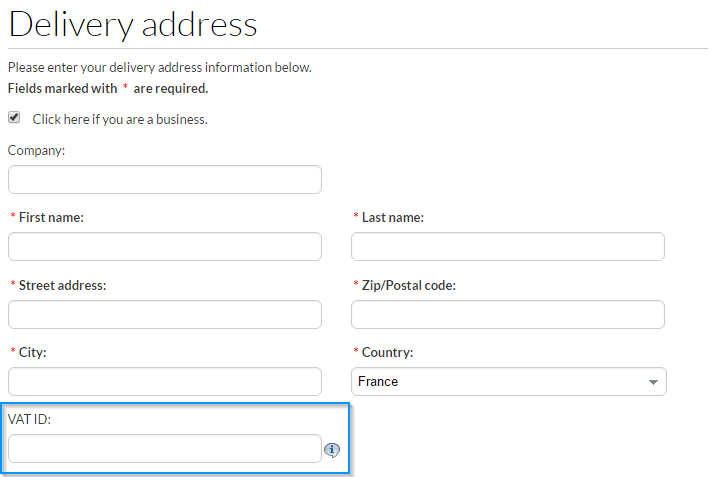

Uk Vat Help Doc Zoho Subscriptions

Uk Vat Help Doc Zoho Subscriptions

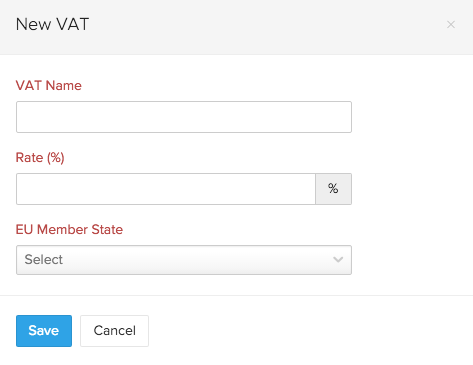

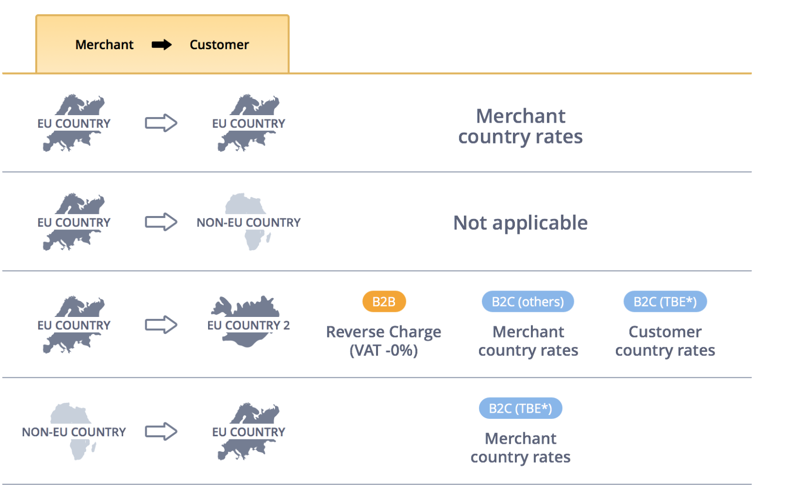

Taxes Eu Vat Chargebee Docs

Taxes Eu Vat Chargebee Docs

Eu Vat Rule Changes And How To Be Compliant In 2015

Eu Vat Rule Changes And How To Be Compliant In 2015

Eu Highest Vat Rates 2017 Oxford Analytica Daily Brief

Eu Sales Vat Rates Veronica Pullen The Mile Deep Marketing Queen

Eu Sales Vat Rates Veronica Pullen The Mile Deep Marketing Queen

Eu To Extend Minimum 15 Percent Vat Rate Onestopbrokers Forex

Eu To Extend Minimum 15 Percent Vat Rate Onestopbrokers Forex

![]() European Union Vat Rates For Amazon Sellers Avalara

European Union Vat Rates For Amazon Sellers Avalara

Standard Vat Rates Applied In Eu Countries 2016 Statista

Standard Vat Rates Applied In Eu Countries 2016 Statista

Vat Rates Applied In The Member States Of The European Union

Vat Rates Applied In The Member States Of The European Union